You can enable VAT calculation for EU marketplaces where Amazon calculates and collects VAT.

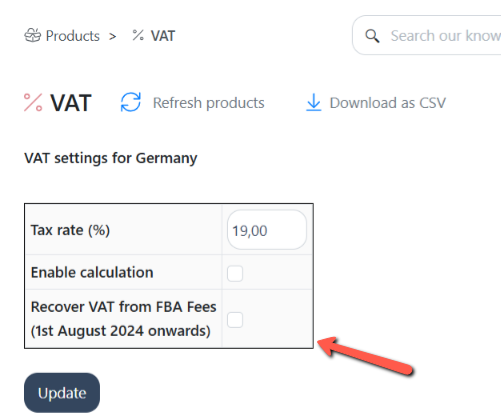

Navigation: Products > VAT

1. On the VAT tab, checkmark the Enable Calculation option

2. You can also adjust the Tax Rate %

3. Click Update.

Once enabled, VAT will be factored into profitability, margin, ROI, and break-even bid calculations.

VAT calculation in SI

VAT = Selling Price / (100 + VAT Rate %) * VAT Rate %

Payout = Selling Price - Fulfillment fee - Referral fee

Profit = Payout - VAT - COGS

Margin = Profits / Selling Price

ROI = ((Payout - VAT) / COGS) - 1

The attached Excel file shows an actual VAT computation for defined parameters.

Recoverable VAT from FBA fees

Enable the Recover VAT from FBA Fees setting to add back the taxes applied by Amazon on FBA fees for EU marketplaces.

The profitability calculations include the recovered amount, ensuring more accurate profit data.